It’s no secret that I am excited about self-employment and the world of freelancing. Just a couple of weeks ago, I published my post Pursuing What I Love or What Brings in the (Stable) Money. I loved all of the wonderful comments that everyone left me, and it really got me thinking.

It’s no secret that I am excited about self-employment and the world of freelancing. Just a couple of weeks ago, I published my post Pursuing What I Love or What Brings in the (Stable) Money. I loved all of the wonderful comments that everyone left me, and it really got me thinking.

Now that I’ve thrown myself out there, I need a plan. And I need to write that plan down or I will completely forget about it.

I know some may think that I am extremely naive for wanting to make the switch, but trust me, I have thought about this a lot. I’m ready to take the next step in my life.

Working for yourself is not all butterflies and beaches, and I realize that. Not everyone has good luck with it, and it doesn’t work out for everyone. Some regret the choice to switch to self-employment…

But some LOVE that they made the switch. There are positives and negatives of working for yourself, and also working for others.

For myself, I see more positives in working for myself rather than the other way around. I want to prepare myself as much as possible also.

Increase savings

This is my most important item on my to-do list. We definitely want to increase our savings before I make the switch. We want to be prepared just in case there is an absolutely horrible month of income.

I would also like to have very limited debt, or just no high interest debt. I’m fine with saving the money and not paying it off if the interest rate is 0%. Luckily right now our income is high and our expenses are relatively low.

Create a new budget

If I will be self-employed and W will be mostly commission at his job, then a new budget needs to be created. Every month will most likely have a much different income level and this all needs to be thought about. We definitely want to continue to live on less than half of our income as well.

I don’t want us to feel like we are struggling because we are stressed about not having any stable income.

Build your freelancing NOW

It is important to build up your freelancing before you decide to leave your day job. Of course this doesn’t always work perfectly for everyone, but this is how I’m approaching self-employment. I have a number in my head for where I would like to be with my freelancing income per month, and I would most definitely prefer to reach that before I make the switch.

I want to build up clients/customers to a point where I 100% believe that I can be successful as a self-employed person.

Health insurance

Health insurance will be very expensive, but luckily I’ll be able to hop onto W’s plan once we get married. Also, health insurance can vary widely. You can get a very cheap plan that pretty much will only be helpful when you are near death and after paying large fees, or you can get something more expensive that will require you to pay less when you visit the doctor.

For me (if I have to pay for my own insurance), since I am still young and never go to the doctor, I will most likely go for something on the cheaper side for monthly payments, and save a heck of a lot of money for any fees and co-payments in a separate medical fund.

Various expenses

For me, luckily I don’t need a lot of expensive machines to do my work. Just a computer and I will be fine. However, before I make the switch, I definitely need to upgrade to a better computer. The one I currently have is becoming more slow each day, and that is just not efficient when you are self-employed. I would also like to work on furnishing my own office area. Right now, I just work wherever.

Diversify your work

This doesn’t have to apply to everyone. However, for me, I would like to be as diversified as I can. This way, if something decreases with one of my jobs, then I will have other areas to fall back on. I am working on adding more side hustles all the time, and the other day added blog management to my list.

I know that most of my work is related to blogs, so I am looking for additional areas as well to expand in. What do YOU do for work?

Taxes – Don’t forget about these!

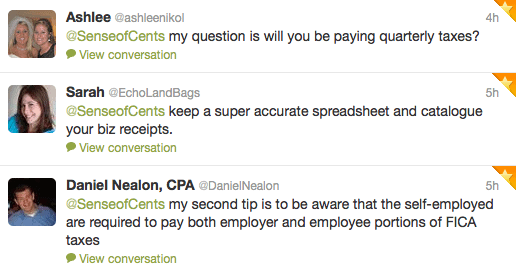

Many of you have asked me if I’m paying taxes. OF COURSE I am paying taxes. I should probably make a post on this as many of you have had questions about self-employment taxes. I am still new to paying these (outside of what I pay at my office job), as I just started working on my side hustles last year. It is no fun to have to pay them but it needs to be done. Taxes are paid quarterly and they are expensive.

Taxes need to be put into our budget as well, and I want to budget on the high side so that there are absolutely no surprises.

Loans will be harder to get approved for

It’s no secret, we are looking for a new house. We plan on buying sooner rather than later (before I make the switch), as I don’t have 2 full years of self-employment on the books. I would hate to make the switch and then not be able to get a home since neither of us have stable income. I know it is possible to get a home, but I’d rather get the best interest rate and also for the home buying process to be as easy as possible (just like the first time we bought a house).

What else am I missing for those who want to make the switch?

Would you ever make the switch to self-employment?

Leave a Reply